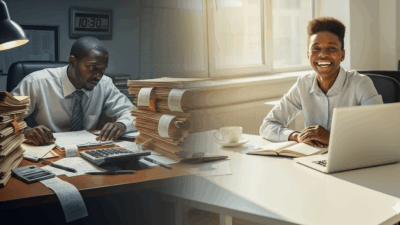

Smart business bookkeeping solutions are transforming how Kenyan entrepreneurs manage their finances, yet many still rely on outdated manual methods.

Running a business in Kenya is tough enough with high taxes, rising costs, and fierce competition.

But here’s the thing, many business owners make it even harder by avoiding proper business bookkeeping systems that could save their operations.

Think about it. Exercise books, scattered receipts, random Excel files, even WhatsApp screenshots for tracking expenses.

These might seem harmless, but they’re quietly destroying businesses across Kenya.

Poor Business Bookkeeping vs Manual Methods: The Shocking Truth About Failures

Let’s talk numbers. Over 70% of Kenyan small businesses don’t survive past year three. That’s a scary statistic, especially when proper business bookkeeping could prevent many of these failures.

According to the Kenya National Bureau of Statistics, “at least 450,000 SMEs die annually in Kenya. This means 30,000 of the SMEs die monthly and at least 1,000 of them daily”.

That’s like losing a business the size of Eldoret every single year.

Here’s what’s interesting though. Most of these businesses didn’t fail because they lacked customers. They failed because they couldn’t track their money properly.

Why Proper Business Bookkeeping Beats Manual Methods

Manual bookkeeping creates problems that compound over time. Let me break this down:

1. Cash Flow Problems Without Proper Business Bookkeeping

Without proper business bookkeeping systems, you’re flying blind. Here’s what happens:

- Receipts get lost in desk drawers – Physical receipts fade, tear, or disappear completely, making it impossible to track legitimate business expenses or claim tax deductions.

- You forget supplier payment dates – Without automated reminders, payment schedules slip through the cracks, leading to late fees and damaged supplier relationships.

- Bank balance shocks become regular occurrences – You check your account expecting one amount but find something completely different, creating panic and forcing reactive decisions.

- Emergency loans become your go-to solution – Poor cash flow visibility means you’re always scrambling for quick financing at high interest rates instead of planning ahead.

The result? Constant financial stress and poor decision-making that keeps your business in survival mode rather than growth mode.

2. KRA Audits Become Your Worst Nightmare

Tax season with manual records is like preparing for war with a wooden stick. Consider these problems:

- Missing receipts mean lost deductions – Every lost receipt represents money you could have legally deducted from your taxes, effectively increasing your tax burden unnecessarily.

- Disorganized records trigger audits – KRA flags businesses with incomplete or messy financial records, leading to time-consuming investigations that disrupt operations.

- Penalties often exceed actual profits – Late filing fees, interest charges, and audit penalties can quickly surpass what your business actually earned that year.

- Hours wasted reconstructing financial history – You’ll spend countless hours trying to piece together transactions from months ago, taking time away from actually running your business.

Many SMEs pay more in KRA penalties than their annual profits. That’s money straight down the drain that could have funded growth or emergency reserves.

3. Banks Won’t Touch Your Loan Applications

Want to expand your business? Need working capital? Banks require one thing: clean financial records.

Manual bookkeeping gives you:

- Incomplete financial statements – Handwritten records don’t provide the detailed profit and loss statements that banks need to assess your business’s financial health and repayment ability.

- Unreliable cash flow projections – Without consistent tracking, you can’t demonstrate steady income patterns or predict future earnings, making lenders nervous about your ability to repay.

- No professional reporting standards – Banks expect standardized financial formats that manual systems simply cannot provide, making your application look unprofessional and risky.

The statistics are brutal. Only 9% of businesses without proper bookkeeping systems qualify for bank loans. The other 91% remain stuck using personal savings, limiting their growth potential and competitive edge.

4. You’re Losing Money Without Knowing It

Here’s a hard truth. Many business owners think they’re profitable until proper bookkeeping reveals otherwise.

Manual systems hide:

- Unprofitable product lines – Without tracking all costs associated with each product, you might be selling items that actually lose money when you factor in materials, labor, and overhead expenses.

- Hidden service delivery costs – Time spent on service calls, travel expenses, and follow-up work often go unrecorded, making services appear profitable when they’re actually draining resources.

- Seasonal profit variations – Manual tracking misses patterns that show which months are truly profitable versus those where you’re just covering basic costs.

- True cost of operations – Rent, utilities, insurance, and other fixed costs don’t get properly allocated across products and services, distorting your understanding of what’s actually making money.

The hustle feels good when you’re busy, but without proper tracking, you might be working 12-hour days on activities that actually lose money.

5. Decisions Based on “Feelings” Cost Millions

When your numbers are messy, you make choices based on gut feelings. This emotional decision-making costs Kenyan businesses millions annually.

Smart businesses use data. Struggling businesses use guesswork.

Why Kenyan Businesses Avoid Digital Bookkeeping Solutions

Despite these obvious problems, the Kenya Bankers Association found that “33% of MSMEs in Kenya still rely on manual forms of bookkeeping”.

Why do smart business owners stick to destructive habits?

Common reasons include:

- “It’s how we’ve always done it” – Tradition creates comfort, but clinging to outdated methods prevents businesses from accessing tools that could dramatically improve their operations and profitability.

- Fear of learning new technology – Many entrepreneurs worry that digital systems are too complex, but modern bookkeeping software is designed to be user-friendly and intuitive for non-technical users.

- Thinking notebooks are “free” – While the initial cost of a notebook seems minimal, the hidden costs of lost receipts, missed deductions, and poor decisions far exceed any software subscription.

- Belief that digital solutions are too expensive – Most digital bookkeeping systems cost less per month than a business spends on phone airtime, making this concern largely unfounded.

The truth? Manual bookkeeping costs far more in lost profits, missed opportunities, and financial mistakes than any digital solution charges in monthly fees.

Why Manual Business Bookkeeping Is Killing Your Kenyan Business

Smart business bookkeeping systems represent a transformational investment that can rescue struggling businesses overnight.

These modern solutions address the unique challenges faced by Kenyan entrepreneurs.

Advanced features provide powerful business insights that were previously available only to large corporations with dedicated accounting departments. Here’s how comprehensive digital expense management transforms business operations across multiple critical areas:

Instant Expense Recording

- Every expense recorded automatically – Transactions from your bank account and M-Pesa get captured in real-time without any manual data entry, ensuring nothing slips through the cracks.

- Photos of receipts stored safely – Your smartphone camera becomes a receipt scanner that instantly digitizes and categorizes paper receipts, eliminating physical storage and loss concerns.

- No more lost documentation – Everything gets backed up to secure cloud servers, so even if your phone breaks or papers get destroyed, your financial records remain intact.

- Real-time expense categorization – Smart systems automatically sort expenses into tax-relevant categories, making it easy to see where your money goes and identify cost-cutting opportunities.

Smart Payment Management

- Automated supplier payment reminders – The system tracks due dates and sends alerts before payments are late, protecting your credit relationships and avoiding penalty fees.

- Customer invoice tracking – You can see which customers owe money, how long invoices have been outstanding, and automatically send professional payment reminders.

- Overdue payment alerts – Get notifications when accounts receivable are approaching or exceeding payment terms, allowing you to take action before cash flow problems develop.

- Cash flow predictions – Based on your payment patterns and outstanding invoices, the system forecasts your future cash position, helping you plan for expenses and opportunities.

Professional Financial Reports

- KRA-ready tax reports in seconds – Generate properly formatted tax returns with all required documentation and calculations completed automatically, eliminating hours of manual preparation work.

- Bank-quality financial statements – Produce professional profit and loss statements, balance sheets, and cash flow reports that meet lending institution standards for loan applications.

- Profit and loss analysis – See exactly which products, services, or time periods generate the most profit, allowing you to focus resources on your most profitable activities.

- Real-time business insights – Access up-to-date dashboards showing key performance indicators, spending trends, and financial health metrics that guide strategic decisions.

Mobile Access Everywhere

- Record expenses on your phone – Capture receipts, log cash expenses, and update financial records immediately using your smartphone, whether you’re at a supplier’s shop or meeting clients.

- Check financial status anywhere – View your current cash position, outstanding invoices, and key financial metrics from any location with internet access, keeping you informed about your business health.

- Work offline when needed – Continue recording transactions and expenses even without internet connection, with data automatically syncing once you’re back online.

- Automatic cloud backup – All your financial data gets continuously backed up to secure servers, protecting against device loss, theft, or technical failures that could destroy years of records.

Why Modern Business Bookkeeping Systems Beat Excel Spreadsheets

Excel feels familiar, but it wasn’t built for business bookkeeping. Here’s the comparison:

Excel Problems:

- Manual data entry errors – Typing numbers and formulas by hand leads to calculation mistakes that can throw off your entire financial picture and cause costly business decisions.

- No mobile access – You can only update spreadsheets from a computer, meaning expenses go unrecorded for hours or days, creating gaps in your financial data.

- No backup protection – If your computer crashes or files get corrupted, years of financial data can disappear instantly with no way to recover the information.

- Can’t integrate with M-Pesa – You must manually type in every mobile money transaction, which is time-consuming and prone to errors or omissions.

- Time-consuming updates – Each entry requires multiple steps and careful formatting, turning simple expense recording into a lengthy daily chore.

Digital Bookkeeping Advantages:

- Automatic transaction capture – Bank and mobile money transactions flow directly into your books without any manual typing or data entry required.

- Mobile apps for instant access – Update your books immediately from anywhere using smartphone apps that work reliably even with basic internet connections.

- Bank-level security – Your financial data gets the same encryption and protection standards that banks use to secure customer information.

- M-Pesa integration – Every mobile money transaction automatically appears in your books, eliminating the tedious task of manual entry and reducing errors.

- Real-time updates across devices – Changes made on your phone instantly appear on your computer and vice versa, ensuring everyone works with current information.

Cost comparison? Most digital solutions cost less than your monthly tea budget but deliver exponentially more value through time savings and improved accuracy.

Your Business Bookkeeping Transformation Timeline

Switching to digital bookkeeping doesn’t require months of complex implementation. Modern solutions are designed for rapid deployment with minimal learning curves, allowing businesses to start seeing benefits within days rather than weeks or months.

Setup (2-3 Hours)

- Quick software installation

- Basic training session

- Import existing data

- Connect bank accounts and M-Pesa

First Month Results

- Week 1: Clean, organized expense tracking

- Week 2: Clear cash flow visibility

- Week 3: Professional financial reports ready

- Week 4: Better business decisions using real data

By month one, you’ll wonder how you ever survived with manual bookkeeping.

The Economic Impact

Kenya’s economy depends on small businesses succeeding. Every business that fails due to poor bookkeeping represents:

- Lost jobs for employees

- Reduced tax revenue for the government

- Missed opportunities for economic growth

The businesses thriving today aren’t necessarily the ones with the most capital. They’re the ones using the right tools.

Ready to Transform Your Business?

You’ve invested too much time, money, and energy to let poor bookkeeping destroy your dreams.

Your choice is simple:

- Stick with manual methods and risk joining the 70% failure rate

- Embrace modern business bookkeeping and build a profitable, sustainable business

The transformation takes just hours. The benefits last a lifetime.

Start your free trial today. No risk, no long-term commitments. Just immediate clarity and control over your business finances.

SEO Keywords Used:

Primary: business bookkeeping Secondary:

- small business bookkeeping Kenya

- automated bookkeeping systems

- digital accounting solutions

- business financial management

- expense tracking Kenya

- SME bookkeeping software

- mobile bookkeeping apps

- Kenya business accounting

Think about it. Exercise books, scattered receipts, random Excel files, even WhatsApp screenshots for tracking expenses. These might seem harmless, but they’re quietly destroying businesses across Kenya.

Poor Business Bookkeeping vs Manual Methods: The Shocking Truth About Failures

Let’s talk numbers. Over 70% of Kenyan small businesses don’t survive past year three. That’s a scary statistic, especially when proper business bookkeeping could prevent many of these failures.

According to the Kenya National Bureau of Statistics, “at least 450,000 SMEs die annually in Kenya. This means 30,000 of the SMEs die monthly and at least 1,000 of them daily”.

That’s like losing a business the size of Eldoret every single year.

Here’s what’s interesting though. Most of these businesses didn’t fail because they lacked customers. They failed because they couldn’t track their money properly.

Why Proper Business Bookkeeping Beats Manual Methods

Manual bookkeeping creates problems that compound over time. Let me break this down:

1. Cash Flow Problems Without Proper Business Bookkeeping

Without proper business bookkeeping systems, you’re flying blind. Here’s what happens:

- Receipts get lost in desk drawers – Physical receipts fade, tear, or disappear completely, making it impossible to track legitimate business expenses or claim tax deductions.

- You forget supplier payment dates – Without automated reminders, payment schedules slip through the cracks, leading to late fees and damaged supplier relationships.

- Bank balance shocks become regular occurrences – You check your account expecting one amount but find something completely different, creating panic and forcing reactive decisions.

- Emergency loans become your go-to solution – Poor cash flow visibility means you’re always scrambling for quick financing at high interest rates instead of planning ahead.

The result? Constant financial stress and poor decision-making that keeps your business in survival mode rather than growth mode.

2. KRA Audits Become Your Worst Nightmare

Tax season with manual records is like preparing for war with a wooden stick. Consider these problems:

- Missing receipts mean lost deductions – Every lost receipt represents money you could have legally deducted from your taxes, effectively increasing your tax burden unnecessarily.

- Disorganized records trigger audits – KRA flags businesses with incomplete or messy financial records, leading to time-consuming investigations that disrupt operations.

- Penalties often exceed actual profits – Late filing fees, interest charges, and audit penalties can quickly surpass what your business actually earned that year.

- Hours wasted reconstructing financial history – You’ll spend countless hours trying to piece together transactions from months ago, taking time away from actually running your business.

Many SMEs pay more in KRA penalties than their annual profits. That’s money straight down the drain that could have funded growth or emergency reserves.

3. Banks Won’t Touch Your Loan Applications

Want to expand your business? Need working capital? Banks require one thing: clean financial records.

Manual bookkeeping gives you:

- Incomplete financial statements – Handwritten records don’t provide the detailed profit and loss statements that banks need to assess your business’s financial health and repayment ability.

- Unreliable cash flow projections – Without consistent tracking, you can’t demonstrate steady income patterns or predict future earnings, making lenders nervous about your ability to repay.

- No professional reporting standards – Banks expect standardized financial formats that manual systems simply cannot provide, making your application look unprofessional and risky.

The statistics are brutal. Only 9% of businesses without proper bookkeeping systems qualify for bank loans. The other 91% remain stuck using personal savings, limiting their growth potential and competitive edge.

4. You’re Losing Money Without Knowing It

Here’s a hard truth. Many business owners think they’re profitable until proper bookkeeping reveals otherwise.

Manual systems hide:

- Unprofitable product lines – Without tracking all costs associated with each product, you might be selling items that actually lose money when you factor in materials, labor, and overhead expenses.

- Hidden service delivery costs – Time spent on service calls, travel expenses, and follow-up work often go unrecorded, making services appear profitable when they’re actually draining resources.

- Seasonal profit variations – Manual tracking misses patterns that show which months are truly profitable versus those where you’re just covering basic costs.

- True cost of operations – Rent, utilities, insurance, and other fixed costs don’t get properly allocated across products and services, distorting your understanding of what’s actually making money.

The hustle feels good when you’re busy, but without proper tracking, you might be working 12-hour days on activities that actually lose money.

5. Decisions Based on “Feelings” Cost Millions

When your numbers are messy, you make choices based on gut feelings. This emotional decision-making costs Kenyan businesses millions annually.

Smart businesses use data. Struggling businesses use guesswork.

Why Kenyan Businesses Avoid Digital Bookkeeping Solutions

Despite these obvious problems, the Kenya Bankers Association found that “33% of MSMEs in Kenya still rely on manual forms of bookkeeping”.

Why do smart business owners stick to destructive habits?

Common reasons include:

- “It’s how we’ve always done it” – Tradition creates comfort, but clinging to outdated methods prevents businesses from accessing tools that could dramatically improve their operations and profitability.

- Fear of learning new technology – Many entrepreneurs worry that digital systems are too complex, but modern bookkeeping software is designed to be user-friendly and intuitive for non-technical users.

- Thinking notebooks are “free” – While the initial cost of a notebook seems minimal, the hidden costs of lost receipts, missed deductions, and poor decisions far exceed any software subscription.

- Belief that digital solutions are too expensive – Most digital bookkeeping systems cost less per month than a business spends on phone airtime, making this concern largely unfounded.

The truth? Manual bookkeeping costs far more in lost profits, missed opportunities, and financial mistakes than any digital solution charges in monthly fees.

Modern Business Bookkeeping: The Complete Solution

Smart business bookkeeping systems represent a transformational investment that can rescue struggling businesses overnight. These modern solutions address the unique challenges faced by Kenyan entrepreneurs, including integration with mobile money systems and KRA compliance requirements.

Instant Expense Recording

- Every expense recorded automatically – Transactions from your bank account and M-Pesa get captured in real-time without any manual data entry, ensuring nothing slips through the cracks.

- Photos of receipts stored safely – Your smartphone camera becomes a receipt scanner that instantly digitizes and categorizes paper receipts, eliminating physical storage and loss concerns.

- No more lost documentation – Everything gets backed up to secure cloud servers, so even if your phone breaks or papers get destroyed, your financial records remain intact.

- Real-time expense categorization – Smart systems automatically sort expenses into tax-relevant categories, making it easy to see where your money goes and identify cost-cutting opportunities.

Smart Payment Management

- Automated supplier payment reminders – The system tracks due dates and sends alerts before payments are late, protecting your credit relationships and avoiding penalty fees.

- Customer invoice tracking – You can see which customers owe money, how long invoices have been outstanding, and automatically send professional payment reminders.

- Overdue payment alerts – Get notifications when accounts receivable are approaching or exceeding payment terms, allowing you to take action before cash flow problems develop.

- Cash flow predictions – Based on your payment patterns and outstanding invoices, the system forecasts your future cash position, helping you plan for expenses and opportunities.

Professional Financial Reports

- KRA-ready tax reports in seconds – Generate properly formatted tax returns with all required documentation and calculations completed automatically, eliminating hours of manual preparation work.

- Bank-quality financial statements – Produce professional profit and loss statements, balance sheets, and cash flow reports that meet lending institution standards for loan applications.

- Profit and loss analysis – See exactly which products, services, or time periods generate the most profit, allowing you to focus resources on your most profitable activities.

- Real-time business insights – Access up-to-date dashboards showing key performance indicators, spending trends, and financial health metrics that guide strategic decisions.

Mobile Access Everywhere

- Record expenses on your phone – Capture receipts, log cash expenses, and update financial records immediately using your smartphone, whether you’re at a supplier’s shop or meeting clients.

- Check financial status anywhere – View your current cash position, outstanding invoices, and key financial metrics from any location with internet access, keeping you informed about your business health.

- Work offline when needed – Continue recording transactions and expenses even without internet connection, with data automatically syncing once you’re back online.

- Automatic cloud backup – All your financial data gets continuously backed up to secure servers, protecting against device loss, theft, or technical failures that could destroy years of records.

Why Modern Business Bookkeeping Systems Beat Excel Spreadsheets

Excel feels familiar, but it wasn’t built for business bookkeeping. Here’s the comparison:

Excel Problems:

- Manual data entry errors – Typing numbers and formulas by hand leads to calculation mistakes that can throw off your entire financial picture and cause costly business decisions.

- No mobile access – You can only update spreadsheets from a computer, meaning expenses go unrecorded for hours or days, creating gaps in your financial data.

- No backup protection – If your computer crashes or files get corrupted, years of financial data can disappear instantly with no way to recover the information.

- Can’t integrate with M-Pesa – You must manually type in every mobile money transaction, which is time-consuming and prone to errors or omissions.

- Time-consuming updates – Each entry requires multiple steps and careful formatting, turning simple expense recording into a lengthy daily chore.

Digital Bookkeeping Advantages:

- Automatic transaction capture – Bank and mobile money transactions flow directly into your books without any manual typing or data entry required.

- Mobile apps for instant access – Update your books immediately from anywhere using smartphone apps that work reliably even with basic internet connections.

- Bank-level security – Your financial data gets the same encryption and protection standards that banks use to secure customer information.

- M-Pesa integration – Every mobile money transaction automatically appears in your books, eliminating the tedious task of manual entry and reducing errors.

- Real-time updates across devices – Changes made on your phone instantly appear on your computer and vice versa, ensuring everyone works with current information.

Cost comparison? Most digital solutions cost less than your monthly tea budget but deliver exponentially more value through time savings and improved accuracy.

Your Business Bookkeeping Transformation Timeline

Switching to digital bookkeeping Kenya systems is easier than you think:

Setup (2-3 Hours)

- Quick software installation

- Basic training session

- Import existing data

- Connect bank accounts and M-Pesa

First Month Results

- Week 1: Clean, organized expense tracking

- Week 2: Clear cash flow visibility

- Week 3: Professional financial reports ready

- Week 4: Better business decisions using real data

By month one, you’ll wonder how you ever survived with manual bookkeeping.

The Economic Impact

Kenya’s economy depends on small businesses succeeding. Every business that fails due to poor bookkeeping represents:

- Lost jobs for employees

- Reduced tax revenue for the government

- Missed opportunities for economic growth

The businesses thriving today aren’t necessarily the ones with the most capital. They’re the ones using the right tools.

Ready to Transform Your Business?

You’ve invested too much time, money, and energy to let poor bookkeeping destroy your dreams.

Your choice is simple:

- Stick with manual methods and risk joining the 70% failure rate

- Embrace digital bookkeeping and build a profitable, sustainable business

The transformation takes just hours. The benefits last a lifetime.

Start your free trial today. No risk, no long-term commitments. Just immediate clarity and control over your business finances.

SEO Keywords Used:

Primary: digital bookkeeping Kenya Secondary:

- small business bookkeeping Kenya

- automated bookkeeping systems

- digital accounting solutions

- business financial management

- expense tracking Kenya

- SME bookkeeping software

- mobile bookkeeping apps

- Kenya business accounting