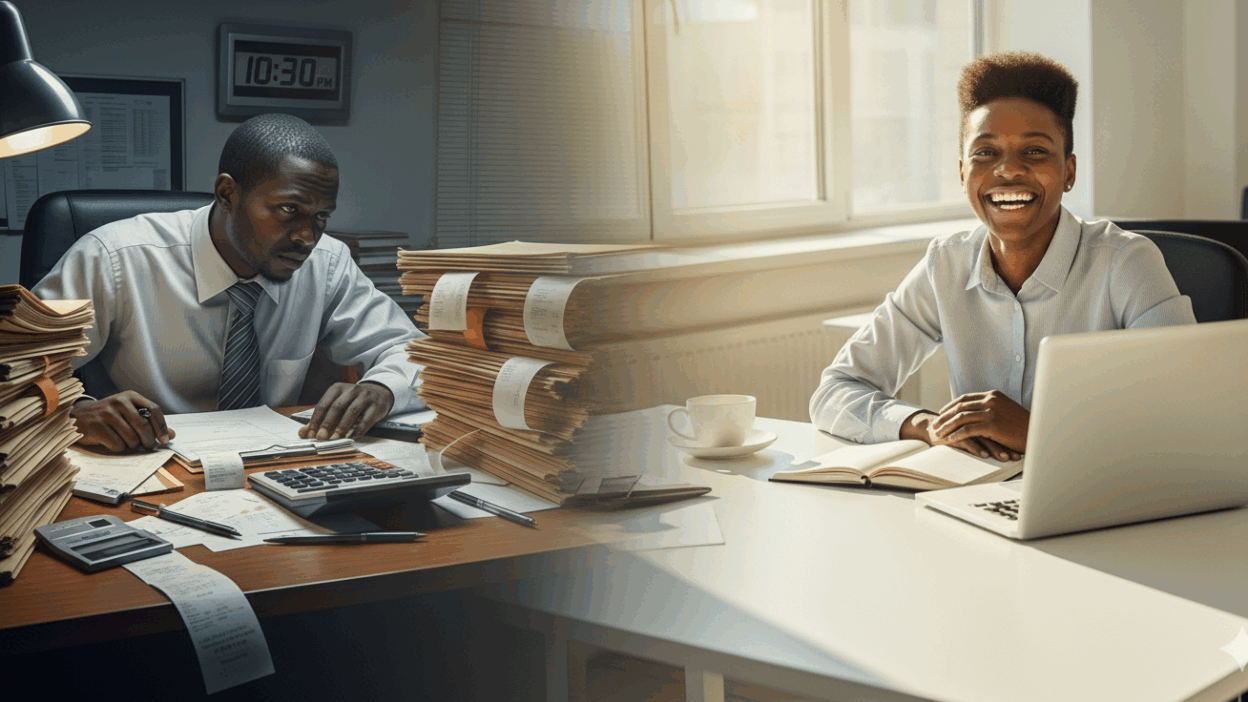

From 80-Hour Weeks to Family Dinners

Hey there, fellow number-cruncher!

I have a question for you.

When was the last time you left the office before 8 PM?

If you’re like most finance professionals I know, you probably can’t remember.

But I’m going to tell you about how finance automation tools changed everything for me.

Hang tight, and let’s get into it…

It’s 8:30 AM, Waiyaki Way traffic is a mess again.

And there you are, stuck behind yet another matatu. You’re getting late for that partnership meeting.

Can’t blame you really. You pulled another late night trying to reconcile employee spend reports. Then HR slides in a payroll request. It’s quietly wrapped in praise for “getting the new finance partner ready for demo.”

Your phone buzzes. Another expense report. Another invoice approval. Another budget variance that needs explaining.

You’re swamped in work. Can’t remember the last time you slept before midnight. Or held your newborn baby for more than five minutes before rushing off to “fix the books.”

There goes the “dad of the year” award. Looks like buying baby toys won’t put up a fight against team mom.

Work-life balance sounds like an out-of-reach luxury, doesn’t it?

Here’s the thing about finance professionals…

We’re the unsung heroes of every business. Sales celebrates their wins. Marketing gets creative awards. We’re in the background making sure the numbers add up.

But somewhere along the way, we became slaves to spreadsheets.

We became prisoners of manual processes.

We became the people who “just handle the numbers” instead of the strategic partners we’re meant to be.

I know because I was there.

Three years ago, I was drowning in receipts, purchase orders, and reconciliation tasks. They seemed to multiply overnight.

My typical day looked like this:

- 7 AM: Check emails (12 new expense reports)

- 8 AM: Traffic jam reflection on life choices

- 9 AM – 2 PM: Endless data entry and approvals

- 2 PM – 6 PM: Meetings about budgets that could have been emails

- 6 PM – 10 PM: “Quick” reconciliation that turns into a forensic investigation

- 10 PM: Drive home to a cold dinner and sleeping family

Sound familiar?

But here’s what changed everything, accounting automation.

Not just any automation. The kind that actually works for real businesses. Not just Fortune 500 companies with unlimited budgets.

Modern finance automation tools handle everything from invoice processing to expense management without breaking your IT budget.

The wake-up call

It was a Thursday evening. My six-month-old daughter was taking her first steps. I missed it because I was chasing a Ksh 500 variance in petty cash.

My wife sent me the video. I watched it from my desk at 11 PM.

That’s when I realized something had to change.

How Finance Automation Tools Transformed My Daily Operations

Within six months of implementing automated finance processes, here’s what happened:

Automated Bill Payment Systems Eliminated Approval Chaos

Remember those endless approval chains for staff salaries, travel expenses, and marketing costs? Finance automation tools made them vanish overnight.

Automated workflows now route payments based on preset rules. Travel expenses get approved instantly when they meet policy requirements. Marketing spends flow through predefined channels. Staff salaries process without you lifting a finger.

Your accounts payable team transforms from glorified data entry clerks to strategic advisors.

Real-Time Expense Tracking Through Accounting Automation

Project costs that used to hide in spreadsheet corners now surface immediately. Labor costs, consultant fees, material expenses – everything shows up in real-time dashboards.

Modern finance automation tools capture expenses across all channels instantly. No more month-end surprises. No more “where did this budget go?” conversations with project managers.

You spot cost overruns before they become disasters.

Automated Payment Processing Solved the Vendor Headache

Your suppliers used to call asking about payment status. Now accounting automation gives them real-time visibility into invoice approvals and payments.

Whether it’s bank transfers, mobile money, or business till payments – everything flows through one platform. Vendors get paid on time. Your reputation improves. Relationships strengthen.

The 3 AM panic calls about unpaid invoices become extinct.

Spending Control Through Finance Automation

Every coin spent now aligns with business objectives. Wastage drops dramatically because real-time monitoring catches unnecessary expenses before they happen.

Finance automation tools provide complete visibility into spending patterns. Your CFO stops asking “why are we over budget?” because you can show exactly where every shilling went and why it mattered.

Strategic Tasks That Still Need Your Human Touch

Here’s what I discovered: accounting automation didn’t replace me. It freed me to do what finance professionals should actually be doing:

Strategic Financial Forecasting

Building predictive models for cash flow. Analyzing market trends and their impact on budgets. Creating scenarios for business growth and expansion.

Business Partnership and Advisory

Advising departments on cost optimization. Helping leadership make data-driven decisions. Translating financial data into business insights that drive growth.

Risk Management and Compliance

Identifying financial risks before they materialize. Developing internal controls and compliance frameworks. Ensuring audit readiness year-round, not just during audit season.

Process Improvement and Optimization

Designing workflows that prevent errors. Training teams on financial best practices. Implementing systems that scale with business growth.

The real transformation

Six months after implementing finance automation tools, something beautiful happened.

I left the office at 4:30 PM on a Tuesday. Not because there was no work. The important work was done.

My daughter saw me walk through the door while she was still awake. She smiled and reached for me.

That night, I helped with bath time. Read bedtime stories. Had dinner with my wife where we talked about something other than work.

Why Finance Professionals Need Automation More Than Ever

The statistics are sobering. Research shows that 71% of finance professionals experience burnout. 58.3% specifically cite lack of work-life balance as the primary cause.

But here’s what the studies don’t tell you: when you implement accounting automation, you don’t just get your time back. You get your energy back. Your creativity back. Your passion for finance back.

The Complete Roadmap to Implementing Finance Automation Tools

If you’re ready to stop being a slave to spreadsheets, here’s where to start:

Phase 1: Audit Your Current Processes

Track what tasks consume your day. You’ll be shocked how much time goes to data entry and manual approvals that finance automation could handle.

Phase 2: Identify Quick Wins with Automation

Start with automated bill payments and expense management. These typically offer the fastest ROI and immediate time savings.

Phase 3: Research Accounting Automation Solutions

Look for platforms that handle everything from petty cash to project expenses. The best finance automation tools work seamlessly across all payment channels.

Phase 4: Pilot and Scale Your Automation

Start small. Measure the impact. Then scale. Don’t try to automate everything at once.

The Compound Effect of Finance Automation

Here’s the thing about reclaiming your time through accounting automation: it compounds.

Those 2 hours you save on bill processing? You invest them in strategic analysis.

That strategic analysis helps you identify cost savings opportunities.

Those cost savings make you look like a financial hero to leadership.

Leadership recognizes your strategic value. They involve you in bigger decisions.

Bigger involvement leads to career growth and better opportunities.

And through it all, you’re home for dinner with your family.

Your Journey to Better Work-Life Balance Starts Now

So here’s my question: What would you do with an extra 10 hours per week?

Would you finally start that CPA you’ve been postponing?

Would you take your kids to the park on Saturday instead of catching up on reconciliations?

Would you have the mental energy to contribute strategically to your company’s growth?

The choice is yours.

You can keep drowning in manual processes. Missing family dinners. Wondering why you chose finance in the first place.

Or you can embrace finance automation tools. Reclaim your time. Remember why you love working with numbers.

The accounting automation technology exists. It’s affordable. It works.

Are you ready to take back control of your life?

Trust me, your family – and your sanity – will thank you for it.

Ready to Transform Your Finance Operations?

Modern finance automation tools can streamline everything from staff salaries to project expenses. Get real-time control over spending while freeing up time for strategic work that actually moves your business forward.

The future of finance is automated. The question is: will you be part of it?

Book A Demo to get a Free account set up and start automating today.